Archive for the 'Market Talk' Category

Monday, February 2nd, 2009

To Sell Or Not To Sell? – Brandeis Closes Rose Art Museum

Rose Art Museum Director, Michael Rush. Image: Erik Jacobs for The New York Times

Brandeis University’s Rose Art Museum is quickly becoming the next art institution to fall victim to the worldwide economic meltdown.

Brandies’ shocking announcement early last week to close the museum and sell off its entire collection of 7,180 works of modern and contemporary art (including Lichtenstein, Warhol, Rauschenberg, de Kooning, Magritte, and recent acquisitions of Richard Serra, Donald Judd, Matthew Barney, Kiki Smith, and Cindy Sherman) has ignited a firestorm of protest. The Association of College and University Museums and Galleries, Association of Art Museum Curators, Association of Art Museums, College Art Association, a joint group 18 directors of contemporary art museums, and the director of the Rose Art Museum himself, have all issued statements voicing adamant disapproval. One of the most disconcerting facts that these voices bring to light is that the Rose is by no means facing financial danger. Rather, it is Brandeis University itself that is in trouble.

In an emotional press release, the Roses’ Director, Michael Rush, had the following to say:

“I want to express to you, the Rose Art Museum community, my shock and horror at the university’s decision to close the Rose Art Museum…Do not be fooled into thinking that the Rose is being closed because it is a financial drain on the university. It isn’t…the Rose, a fundamentally self sustaining entity within Brandeis, is in relatively good financial health. The Rose is being closed due to the University’s desire to sell the cherished collection. Period.

Read on for the full story. Read the rest of this entry »

Wednesday, January 28th, 2009

Watch Your Collection Loose Value

Artprice, a popular online source for art market information, including auction and artist sales records, has just announced the launch of My Art Collection, a free online portfolio service that estimates the value of subscribers’ collections. Once registered, members can upload information regarding individual works in their collection to a private account. Artprice will provide quarterly updades on the overall value of the collection, as well as each piece of art work. Perfect timing to watch your collection lose value as we sink deeper into the recession….

Monday, January 26th, 2009

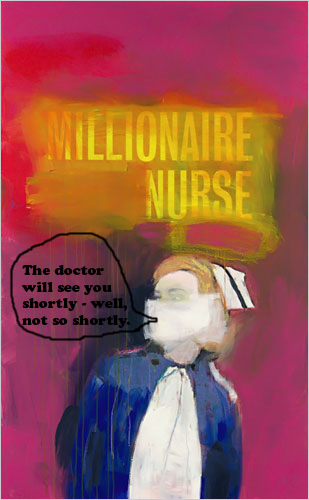

Richard Prince Sued for Copyright Infringement

Art star, Richard Prince, is the subject of a new lawsuit. The suit was filed Dec. 30, 2008 on behalf of plaintiff, ethnographic photographer, Patrick Cariou. Cariou claims that Prince illegally used his photographs to produce the recent Canal Zone mixed media series. Gagosian Gallery and its owner Larry Gagosian (who exhibited and sold the works), along with book publisher, Rizzoli (responsible for the exhibit catalog), are also named as co-defendants.

Back to the Garden, 2008 is one of 20 disputed paintings in Patrick Cariou’s lawsuit against Richard Prince. Image: Gagosian Gallery Patrick Cariou???

The images in question first appeared in Cariou’s book,Yes Rasta (published in 2000 by Powerhouse), and were based on a decade of anthropological study conducted in Jamaica. According to the suit, “none of the Defendants were ever authorized by Plaintiff to appropriate the Photographs, or reproduce, display, or distribute the Photographs, or to adapt the Photographs in order to create the Paintings or any other derivative work based on the Photographs. Defendant’s conduct was and continues to be in willful disregard of Plaintiff’s rights under the Copyright Act.”

Aside from undisclosed monetary damages, Cariou is claiming the “Defendants be required to deliver up on oath for impounding, destruction, or other disposition, as Plaintiff determines, all infringing copies of the Photographs, including the Paintings, any unsold copies of the Canal Zone Exhibition book, in their possession,” and be required to current owners of the paintings that they “were not lawfully made under the Copyright Cct of 1976 and that the Paintings cannot be lawfully displayed.”

See a copy the full suit here

Thursday, January 22nd, 2009

Survey Says? – Contemporary Market Bottoming Out

The contemporary art market is officially in a depression and, like the global economy at large, will not recover for several years – three to five to be exact, according to a recent ArtTactic study (also cited in a Jan. 20 Bloomberg report).

Conducted once every two years, Art Tactic’s biennial study suggests that confidence levels in the contemporary art market have fallen from an indicator level of 56 to just 10.8, declining 81% since May of last year. The latest study is based on a survey of 145 European collectors, dealers, and auction house specialists, as well as auction results from both Christies and Sotheby’s latest New York evening contemporary art sales – both of which failed to meet low estimates, with approximately one third of all lots remaining unsold. The combined revenue (including fees) from these tell-tale sales reached a mere $238.7 million, 37% below their 2007 total of $640.9 million.

Over half of all respondents believe it will take more than three years for the contemporary art market to recover (with more than 50 percent of that sub-group feeling the market will take over five years to bounce back). 47 percent of those surveyed believe auction prices will continue to fall and bottom out between 30-50% from their May 2008 totals.

In addition to their Art Market Confidence Survey (conducted since 2005), Art Tactic has launch their new Art Market Survival Rating, which assesses the impact of the market on specific artist’s careers over the next decade. The new indicator is divided into two categories – contemporary artists (including Andreas Gursky, Cindy Sherman, Damien Hirst, Elisabeth Peyton, Jeff Koons, Jeff Wall, Luc Tuymans, Marlene Dumas, Matthew Barney, Paul McCarthy, Richard Prince, Takashi Murakami, and Gerhard Richter), and contemporary blue-chip artists (including Sol Le Witt, Dan Flavin, Ellsworth Kelly, Robert Rauschenberg, Willem de Kooning, Mark Rothko, Roy Lichtenstein, Francis Bacon, Andy Warhol, Joseph Buys, George Segal, and Robert Indiana). An overall downward trend is evident even when considering a group of artists that many believed could be insulated from the financial shock suffered by the market at large. This should come as no surprise, especially in in the wake of recent talk surrounding the slump in Damien Hirst’s market.

We’re expecting to see these dismal predictions further substantiated as results emerge from the upcoming round of London contemporary art auctions. Follow the troubling action here:

Feb 5 – Sotheby’s – Contemporary Evening Sale

Feb 6 – Sotheby’s Contemporary Day Sale

Feb 11 – Christies – Post-War and Contemporary Art Evening Sale

Feb 12 – Christies – Post-War and Contemporary Art Day Sale

Feb 12 – Phillips de Pury – Contemporary Art Evening Sale

Feb 13 – Phillips de Pury – Contemporary Art Day Sale

Wednesday, January 7th, 2009

It Was A Very Good Year or Hey Hey, Goodbye!

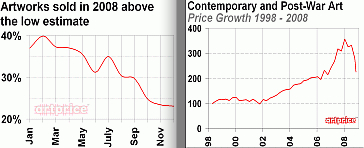

Images via artprice

Has Damien Hirst committed professional suicide and is he’s taking the rest of the art market with him?

Over past few weeks, the hot topic for art critics has been speculation that not only may Hirst’s monumental Sotheby’s sale turn out to be his achilles heel, but the breaking point for the entire art market. Has the record shattering auction signaled the end of a reeling market bubble and incessant speculative buying? Since the September 15th sale, several signs suggest that Hirst’s prices are dropping, with more and more works failing to find buyers at auction and international fairs.

Over on artnet, Charlie Finch makes some colorful predictions for the coming year, wryly suggesting, “DAMIEN HIRST’S CAREER IS OVER,” and “like those of Schnabel, Cucchi, Salle and other victims of the late 1980s crash, [his] values will never recover.” The lesson learned from Schnabel’s trajectory through the 1980s is well known. Over the span of two years from 1979 to 1981, prices for Schnabel’s work skyrocket from $6,000 to $40,000 per painting. Then, after soaring through the decade riding the back of an over-inflated market built largely on ego and celebrity, the career of the self-proclaimed “most famous painter in America” suffered a critical collapse. By the 1990s he had all but disappeared from the art world, reemerging as a film director in 1997 with the biopic, Basquiat. Will Hirst suffer the same fate, and will the general art market tumble along with him?

Clearly, the downward spiral seems to be holding true for the market at large. Art Market Insight notes that during 2007 and 2008 (before mid-September) 80% of works offered at auctions with estimates over 1 million euros were sold. However, beginning September 17, 2008, the day after the Hirst sale, only 55% of works offered in this price range found buyers. Furthermore, buyers have become much more modest in their bidding – Prior to the Hirst auction 35% of lots offered (all works, all periods) sold above their low estimate. After September 16, this deflated to a mere 24%.

With an estimate of $3-4 million, Damien Hirst’s 2007 spin painting, “Beautiful Artemis Thor Neptune Odin Delusional Sapphic Inspirational Hypnosis Painting” went unsold at a Nov 13, 2008 Phillips de Pury auction. (Image via Phillips de Pury)

A December 31 Bloomberg report argued that “Hirst’s record Beautiful Inside My Head Forever sale and collapse of Lehman Brothers Inc. in September marked the turning of the art market in 2008,” including the recent failed sale of Hirst’s “Beautiful Artemis Thor Neptune Odin Delusional Sapphic Inspirational Hypnosis Painting,” (the spin painting went unsold at Phillips de Pury this past November, despite a $1.8 million reserve on a piece estimated between $3 – 4 million), and weak results at Art Basel Miami.

The verdict may not be unanimous though. Art Market Monitor does a good job of pointing out the weaknesses of the Bloomberg claims, and The Telegraph’s Colin Gleadell reminds us us that as recenlty as a late December sale, “Hirst’s spot prints and spin paintings opened to unanimous approval. Within days, all but five of the 22 works had been sold. Prices ranged from £10,000 to £250,000.

While disagreement remains over the future of Hirst, no one seems to be arguing the dire state of the overall market. That is no one except the auction houses themselves.

Wednesday, December 31st, 2008

Asian Art Fair Cancelled

In a move reflecting the current slump in the global art market and mixed results at Basel Miami fairs earlier this month, The International Asian Art Fair, (previoulsy scheduled to be held at the Park Avenue Armory from March 11-15) has been cancelled by London-based Haughton International Fairs.

A statement released on the fair organizer’s website states: “Due to the present global economic situation we have regrettably taken the decision to cancel The International Asian Art Fair for 2009…Many of the dealers who had contracted to take part are not in a position to go forward in the current climate and as such we have decided a fair would put an untenable strain on their resources. We hope to be able to re-launch the fair in 2010 and look forward to working with our exhibitors again.”

With just a few remaining hours of the year left, indeed this is one more reminder that tonight we should all party like its 1999.

Friday, December 19th, 2008

Sotheby’s Claims Contemporary Market Remains Strong

In an effort to instill confidence, Sotheby‘s has posted a video concerning the state of the contemporary art market during bleak financial, times. Speaking candidy about the current economic climate. Tobias Meyer (Worldwide Head of Contemporary Art), Alexander Rotter (New York Head of Contemporary Art), and Leslie Prouty (Senior Vice of Contemporary Art) still manage to express overall optimism in the market. A few main messages are conveyed:

•This is a buyers market with many oportunities

•Good works will always have a strong market

•The current economic climate has led to a shift in auction strategy – During the boom of the past several years, works were estimated aggressively, with the goal of finding collectors to meet those expectations. To continue matching buyer’s with seller’s, new strategy finds the auctioneer focusing on buyer’s expectations and bringing works to auction with more moderate pricing.

•The contemporary market has a firm foundation, backed by the support of a committed collector base

Watch the video here

Thursday, December 18th, 2008

The Big Takeover

Image: © Original Artist / cartoonstock.com

Seasoned art and culture critic, Lee Rosenbaum, has written some interesting commentary over the last several days regarding Los Angeles County Museum of Art’s proposed “merger” with the Los Angeles Museum of Contemporary Art. As previously reported, MOCA is at the brink of financial collapse and is in dire need of rapid injection of funds.

In a press release issued Dec. 16, LACMA stated the “goal of this plan would be to preserve the independence and integrity of both institutions while combining their operations and infrastructure,” including a “merger of Board leadership,” and the ability for MOCA’s permanent collection to be housed and exhibited in LACMA’s several museum spaces.

Rosenbaum calls the plan an attempted takeover, and a move by LACMA and its Director/CEO, Michael Govan, to take advantage of a struggling MOCA in its time of need, arguing that “instead of being a perpetrator of pernicious takeover mischief, Michael Govan should have been a collaborative colleague, offering to provide space and support for MOCA’s insufficiently exhibited, superb permanent collection, without insisting on assuming control over it (as would happen under a single-board, single-director merger).”

Since LACMA’s announcement this past Tuesday, several voices have spoken out against the deal, or offered alternative plans. Grassroots organization MOCA Mobilization has delivered a petition of 3,200 signatures to MOCA’s board, stating “we support an independent and autonomous MOCA. We condemn any plan now or in the future to merge MOCA with any other institution.” Furthermore, in an effort to stall the merger, a motion was filed by the Los Angeles County City Council, petitioning the city’s Community Redevelopment Agency to give MOCA $2.8 million in rent money. In return, the museum would agree to accept $30 million in financial assistance offered by philanthropist Eli Broad.

Read more at: CultureGrrl

Tuesday, December 9th, 2008

Art Basel Miami Recap – Part 1

The Art Collectors presents the first installment of our extensive coverage of Art Basel Miami and its surrounding satellite fairs.

Undoubtedly there was a significant downturn to the feverish buying frenzy of the boom of the past several years. Although there was less spending and decadence in the air, overall, spirits remained hopeful as the week progressed.

Reporting for the Times London, Sarah Thornton describes the five-day affair as yet another measure of a market that has “slowed down dramatically but averted a crash, mainly as a result of the skilful driving of dealers and the return of serious collectors who were ‘priced out of the market’ during the boom by fast and high-spending billionaires,” and a somber tone of “deep relief, as there were enough transactions at the fair to demonstrate that art is still a liquid asset.” (full story here)

The less that disasterous slump was substantiated by a Miami Herald survey of 86 galleries and dealers – 41 exhibiting at Basel, and another 45 from satellite fairs. Over 70 percent experienced flat or slight decreases in prices. The Herald notes that this does not account for reports of major discounting. Half reported smaller crowds and less potential buyers. Even with these somewhat bleak reports, 60 percent of exhibitors surveyed were ”extremely likely” to return next year. (full story here)

Despite the overall somber tone, crowds flocked to view a massive mix of established heavyweights and up-and-coming stars of international modern and contemporary art. Here is part one of our Art Basel recap, to be followed up with a closer look at satellite fairs and a special focus on some of our favorites from the past several days.

Lots more to see after the jump… Read the rest of this entry »

Wednesday, November 26th, 2008

Emmanuel Perrotin Launches Investment Fund

These are exciting times for Emmanuel Perrotin. Just a few short weeks after reinstating his representation of Damien Hirst, the international gallery owner has announced the launch of Artists’ Dreams, an investment firm that will pool collectors’ funds to finance the production of major works of art. By removing financial barriers to otherwise cost prohibitive projects, the venture will allow emerging artists to compete with art titans such as Hirst and Koons, whose monumental success has risen with the production of large scale installation and museum-worthy works.

The arrangement will upset the traditional gallery – artist relationship, in which profits are typically split evenly. Works will be sold exclusively via Perrotin’s Miami and Paris galleries, and investors would share in the dealer’s profits, based on initial investment. This is not Perrotin’s first foray into this sort of investor relationship. He pooled collector funds for the production of Piotr Uklanski’s 1996, Untitled (Floor Dance), which went on to be exhibited at the Guggenheim in 2007.

The Art Collectors eagerly awaits to see which artists will be the lucky benefactors of these potentially career-shaping funds.

Source: Art Observed / The Art Newspaper