Archive for the 'Market Talk' Category

Wednesday, May 13th, 2009

Sotheby’s Contemporary Art Evening Results

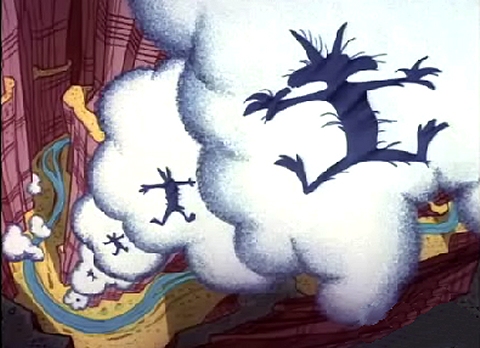

Dan Colen’s Untitled (Blow Me), 2005, was a strong performers at Sotheby’s May 2009 Contemporary Art Evening Sale, selling for $386,500, above its initial high estimate of $150,000.

Sotheby’s kicked off the latest round of Spring Contemporary Art auctions last night, with Christie’s and Phillips set to follow over the next two days. The sale in indicative of the overall shift in auction house strategy, with far fewer lots offered (48 compared to last May’s 85), many with inticingly modest estimates. The total realized (including buyer’s premiums) amounted of $47,033,500, compared to the $362,037,000 raised at last year’s May Contemporary Art Evening Sale.

Read on for our full analysis. Read the rest of this entry »

Friday, May 8th, 2009

ArtTactic Launches Podcast Series

Art market research firm, ArtTactic, has just launched a free podcast series, focusing on market analysis and interviews with with key art market figures. In the first edition, host, Adam Green, conducts an insightful conversation with art dealer and author, Richard Polsky, about the catalysts behind the decline in the global market and how this has affected the selling strategies of auction houses and galleries alike. If this segment is any indicator, the series will be a good one to follow.

Listen here

Thursday, May 7th, 2009

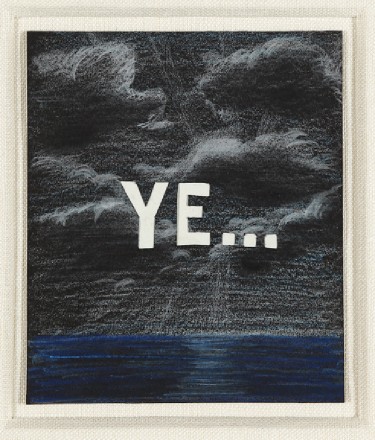

MOCA Benefit Auction

It should come as no surprise that now more than ever, the Los Angeles Museum of Contemporary Art is in need of financial support. This Saturday, May 8, MOCA will hold its annual Fresh Silent Auction, with works donated from a massive list of over 300 artists, including Ed Ruscha, Raymond Pettibon, Mark Ryden, Martin Kippenberger, Barbara Kruger, Christopher Wool, Neo Rauch, Robert Rauchenberg, and Andrea Zittel. The event takes place at the Geffen Contemporary in Los Angeles from 7-11pm. View the full list of contributing artists here and purchase tickets here.

As you may recall, late last year the museum announced that it was on the verge of total financial collapse, ultimately opting for a $30 million private injection from billionaire Eli Broad, along with the resignation of director, Jeremy Strick, and massive financial restructuring.

Read more from us on the MOCA’s recent financial here and here

One of our favorite lots – Ed Ruscha – Ye, 1991. Cut Out Lettering, Color Pencil on Black Paper.

Wednesday, April 22nd, 2009

Art Market Free Panel Discussion in NY

If you are in New York tonight, FIT will host Regrouping: art world professionals examine the art market. The panel discussion will assess the current state of the art market and outlook for its future. The event will be moderated by Sheri L. Pasquarella, co-founder of NADA (New Art Dealers Alliance) and features the floowing panelists:

7th Ave at 27th St.

Free

Tuesday, April 21st, 2009

Buy Art on the Government’s Dollar

The Telegraph clues us in to a UK government backed loan program which aims to fuel the art market with millions in revenue, while making the collecting game a bit more egalitarian. The Own Art program, funded by the government-run Arts Council England, hands out up to £2,000 in individual loans for the purchase of art, completely interest free and repayable over a ten month period. According to the Telegraph, 25% of those who have taken advantage have an annual income below the national average wage, and to date £6.5 million in revenue has been generated for artists.

We’ve taken a look and should clarify that the program does not apply to all galleries and includes approximately 250 participating venues across England. The £2,000 limit may be used for a single purchase, or spread out over the acquisition of multiple works. While only one loan is permitted at any given time, there is no limit to how many times an individual may use the program. The 0% APR is subsidized by Arts Council England, which pays all interest to the lending bank instead of the customer.

The program is also available at 38 galleries throughout Scotland, via the Scottish Arts Council and over 80 galleries in Wales via Principality Collectorplan, where it has been in operation for over 20 years.

Back in the U.S., these loan programs are worth considering, given the debate over the $50 million given to the National Endowment for the Arts via the Economic Stimulus Act. Opponents have argued there are far more crucial economic factors, including rising unemployment, to justify pumping millions of taxpayer dollars into the arts, while others have claimed the amount is far too miniscule (less than 1% of the approximately $800 billion Stimulus Act), and those in arts related professions need aid as well. Rather than residing to the Roosevelt-esque New Deal tactics employed during the Great Depression, perhaps such government backed loan programs would do more to not only fund the arts but fuel the economy at large, by promoting consumer spending and freeing up the lending capabilities of our nation’s financial institutions.

Friday, April 3rd, 2009

Controversy Over Cohen’s Women at Sotheby’s

Edvard Munch’s Madonna is on display at Sotheby’s NY, as part of Women: An Exhibition of Paintings & Sculptures On Loan from the Steven & Alexandra Cohen Collection.

Modern Art Obsessions has posted some criticism of Sotheby’s exhibition of a selection of billionaire, Steven Cohens’ private collection. Cohen now owns almost 6% of the auction house, and while Sotheby’s has stated none of the 20 works are for sale, concerns over possible nepotism and market manipulation have emerged. Read MAO’s thoughts here and Lindsay Pollock’s report for Bloomberg here.

Friday, March 20th, 2009

Transparency in Deaccession

Image still from IMA’s online Deaccession Database

While the debate over museums’ rights to relinquish works of art continues, the Indianapolis Museum of Art has taken a step in the direction of full disclosure, launching an online database of deaccessioned or soon to be sold works from its collection. Along with detailed sales records, the site also allows comments from the public, who wish to weigh in on the museum’s decisions. As reported by Culture Grrl, IMA already has plans to improve these listings with information regarding how funds raised from the sale of specific works are applied to the acquisition of new art.

IMA Director and CEO, Maxwell Anderson commented on the endeavor, stating, “In light of the recent economic downturn and the resulting financial strain experienced by museums, the topic of deaccessioning has become a front-burner issue, making institutional transparency more vital than ever. This searchable database will evolve to include information regarding how the IMA uses funds from deaccessioned works to enhance and shape the Museum collection.”

In a further mover towards transparency, the museum has published its Deaccession Policy, which clearly abides by the Association of Art Museum Directors code of ethics, stating that “funds received from all sales of works of art will be used for the purchase of works of art from the same period or culture.”

The IMA’s initiative comes in the wake of recent controversy concerning both the National Academy and Brandies University’s sale of art to meet operating costs. After The Academy sold two Hudson River School paintings this past December, The Association of Art Museum Directors implemented sanctions barring the institution from borrowing from other museums. Last week the AAMD met with National Academy representatives to discuss how they could achieve financial stability without further deaccession. A joint statement published 3/11 on the AAMD website, indicates the Academy “will begin a process to restructure its governance practices” to “include more rigorous fiscal oversight,” and halt the sale of “additional works of art as was originally proposed.”

Thursday, March 5th, 2009

Going, Going, Gone – Corporate Philanthropy to Arts Plummeting

We’ve already seen the dramatic effect of the reeling economy on the arts, as several museums announce layoffs, cuts in programming, or outright closure. As reported by ArtInfo, a new study by business analysts, The Conference Board, predicts that corporate philanthropy will plunge further throughout 2009, with charitable giving to the arts taking the biggest hit. According to the survey of 158 companies, 45% had already implemented a reduction in their 2009 giving budgets and 41% reporting a decrease in funding for the arts. These numbers are likely to rise as the year unfolds.

Wednesday, February 25th, 2009

Economy Continues to Batter Museums

As reported by the Philadelphia Inquirer, The Philadelphia Museum of Art announced a 7% staff reduction (comprised of 16 currently held jobs and the elimination of 14 vacant spots), and 5-10% salary cuts for senior personnel. With crucial endowment funds down more than 25%, Chairman, H.F. “Gerry” Lenfest, warned that if “endowment keeps being reduced in value there are going to be further steps taken.

Similar troubles have hit the Detroit Institute of Arts. The Detroit Free Press reports the purge of 63 employees (a 21% reduction of its 301 person staff) and substantial cutbacks in programming. In total the museum will save $6 million from its $34 million yearly budget.

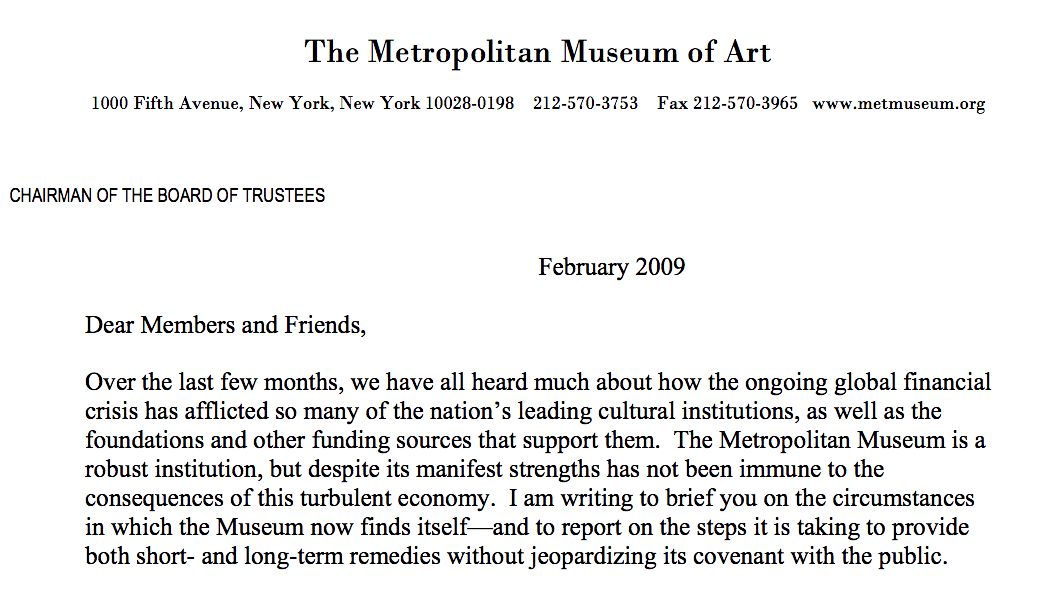

The dismal news has even hit the largest of institutions, arriving at the doorstep of the Metropolitan Museum of Art. In a letter posted on the museum’s website (previewed above), Chairman of the Board of Trustees, James R. Houghton, cited a 25% decrease in endowment funds (which provide 30% of operational costs) since June 2008 and announced an all-out hiring freeze and the permanent closure of fifteen satellite museum shops around the country. In addition, Houghton warns of the inevitable future, stating the Met “has also launched a thorough assessment of all of its publications, exhibition programs, and administrative services in a determined effort to reduce costs. Inevitably, there will be additional actions to come.”

Added to an ever inflating list of fiscally troubled institutions, including MOCA, The National Academy, and Rose Art Museum, this news does not bode well for the foreseeable future of public arts.

Tuesday, February 24th, 2009

Results in for Yves St. Lareunt Art Auction

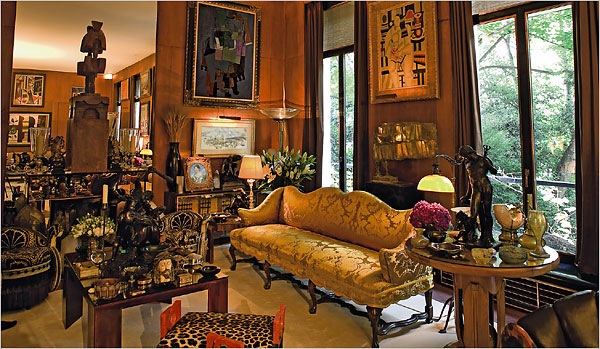

In the weeks leading up to the landmark sale, Chrisite’s has conducted private viewings of auction lots in their original setting, the Parisian home of Yves St. Laurent and Pierre Berge.

Image: New York Times.

Yesterday marked the beginning of the highly anticipated three-day auction of the collection of the late Yves St. Laurent and lifelong partner, Pierre Berge. Christie’s spared no expense of the extravaganza, having spent over $1 million to rent and refurbish Paris’ famed Grand Palais, with seating for more than 1,000 potential buyers, 100 phone lines, and eight auctioneers working in shifts. In an event nothing short of spectacular, the sale of 733 lots representing fifty years of collecting, ranging from modern and impressionist masters, to decorative arts and even rare archaeological gems. The largest ever single sale of privately owned art was tactfully estimated to fetch a modest $250 – $380 million (significantly less than the pre-financial meltdown estimate of $600 million).

Results are in for the first two days of sales. Of particular interest are the final figures for the Feb. 23rd Impressionist and Modern Art sale, which realized a total of $266 million. The list of represented artists was unarguably astounding – Goya, Munch, Matisse, Gaugin, Degas, Mondrain, Cezanne, Brancusi, Leger and Duchamp were all here. While the most notable lot, a 1914-15 Picasso, entitled Musical Instruments on a Table (estimated at $31 -$38 million) failed to find a buyer, several other works seemingly fared quite well, outshining initial auction estimates. Matisse hit an all time auction record, when Cowslips, blue and pink carpet sold for $46.4 million, despite its original estimate of $15.5 – $23.2 million, and a prime example of Mondrian’s abstract paintings went for $27 million, with an initial estimate of only $9 – 13 million. However, it must be mentioned that in such a deflated market, intentionally low auction house estimates may have set the stage to guaranteed surface level success.

Read on for auction highlights. All sale prices include buyer’s premium. Read the rest of this entry »